WELCOME TO THE

CENTRAL MIDWEST CARPENTERS

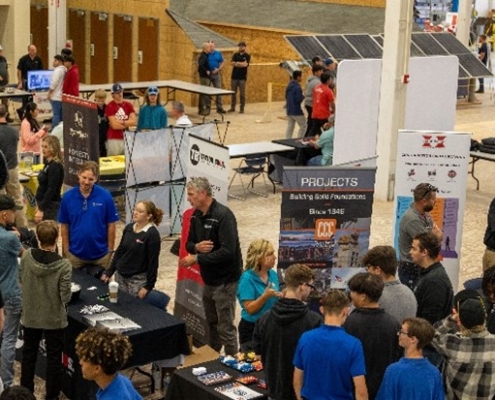

The Central Midwest Carpenters Union represents over 35,000 professional tradespeople in 36 locals in Indiana, Ohio, and Kentucky. A proud affiliate of the United Brotherhood of Carpenters, which has a century-plus tradition of representing the best of the building trades, the council works in partnership with thousands of contractors, helping them find the best possible talent for their projects.